What Is A Deductible Health Insurance

In the labyrinth of health insurance, the term "deductible" often stands as a significant puzzle piece determining your healthcare costs. Let's delve deeper into this fundamental aspect, deciphering its meaning, implications, and how it navigates your healthcare journey.

Unveiling the Deductible

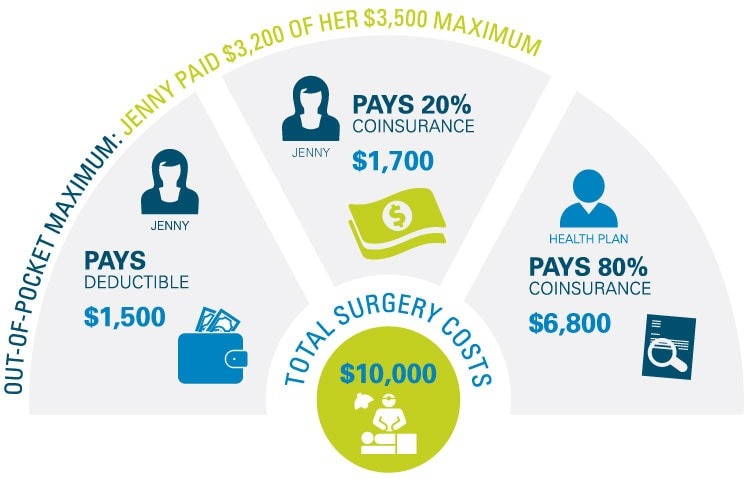

A deductible in health insurance refers to the amount you must pay out of pocket before your insurance plan starts shouldering the expenses. It's akin to the threshold you need to cross before the safety net of your insurance catches you. For instance, if your deductible is $1,000, you'll cover the initial $1,000 of your medical expenses, and after that, your insurance kicks in.

Understanding its Impact

The size of your deductible significantly influences your insurance premiums. A higher deductible often translates to lower premiums and vice versa. It's a delicate balancing act between what you pay upfront and what you pay monthly.

The Human Element

But let's pause for a moment from the technicalities. The deductible isn't just a financial term; it's a chapter in everyone's life story. It's the extra shift you take to save for unexpected medical emergencies. It's the strategic planning you do to ensure your family's well-being without breaking the bank. It's about moments of vulnerability and resilience, a testament to human adaptability in navigating the complexities of healthcare.

Making Informed Decisions

When choosing a health insurance plan, understanding deductibles becomes pivotal. Consider your health needs, financial capabilities, and risk tolerance. A lower deductible might bring peace of mind but might come with higher premiums. Simultaneously, a higher deductible could mean more significant initial costs but lower monthly payments.

Conclusion

In the tapestry of health insurance, the deductible forms a crucial thread, weaving together cost, coverage, and personal well-being. It's not just a financial checkpoint; it's a milestone in one's health journey, demanding attention, understanding, and informed decision-making.