How To Calculate Finance Charge

As a consumer, you’ve likely seen “finance charges” appear on bills for loans, credit cards, or installment plans. But what exactly are finance charges and how are they calculated? In this beginner-friendly guide, we’ll unravel the mystery behind this common fee.

What is a Finance Charge?

A finance charge refers to the total cost of borrowing money or buying on credit. It includes interest costs plus any additional fees connected to the loan or purchase. Finance charges are typically represented as an annual percentage rate or APR. This expresses the total finance cost over the full year.

Common Finance Charges

Some types of costs that get bundled into the finance charge include:

Interest - What you pay to borrow money, usually a percentage of the total amount.

Service fees - Processing fees or maintenance fees charged by the lender.

Penalties - Late fees or other penalty charges related to the account.

Insurance - Credit protection policies like debt cancellation coverage.

Calculating the Finance Charge

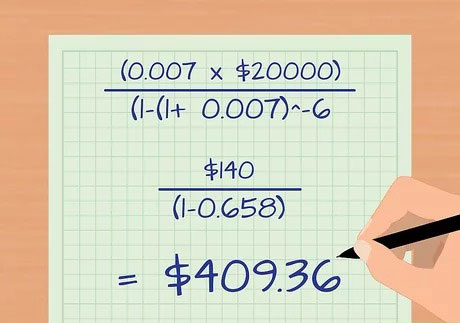

Now let’s walk through how to calculate a finance charge step-by-step:

Identify all costs of the loan or credit purchase over its full term. This includes interest, fees, insurance, etc.

Add up the total dollar amounts for each of these finance costs over the full time period.

Divide this total finance cost by the original loan or purchase amount.

Convert the resulting number to a percentage. This gives you the annual percentage rate (APR) or finance charge.

For example:

Loan Amount: $10,000 Total Interest Paid Over 1 Year Term: $1,200 Fees Paid: $300 Insurance Premiums: $400

$1,200 + $300 + $400 = $1,900

$1,900 / $10,000 = 0.19 0.19 x 100 = 19% APR (finance charge)

Understanding how finance charges are calculated helps you better evaluate the true cost of financing. Next time you see a finance charge, you’ll know exactly what’s bundled into the total costs.