How Much Does Health Insurance Cost

Introduction

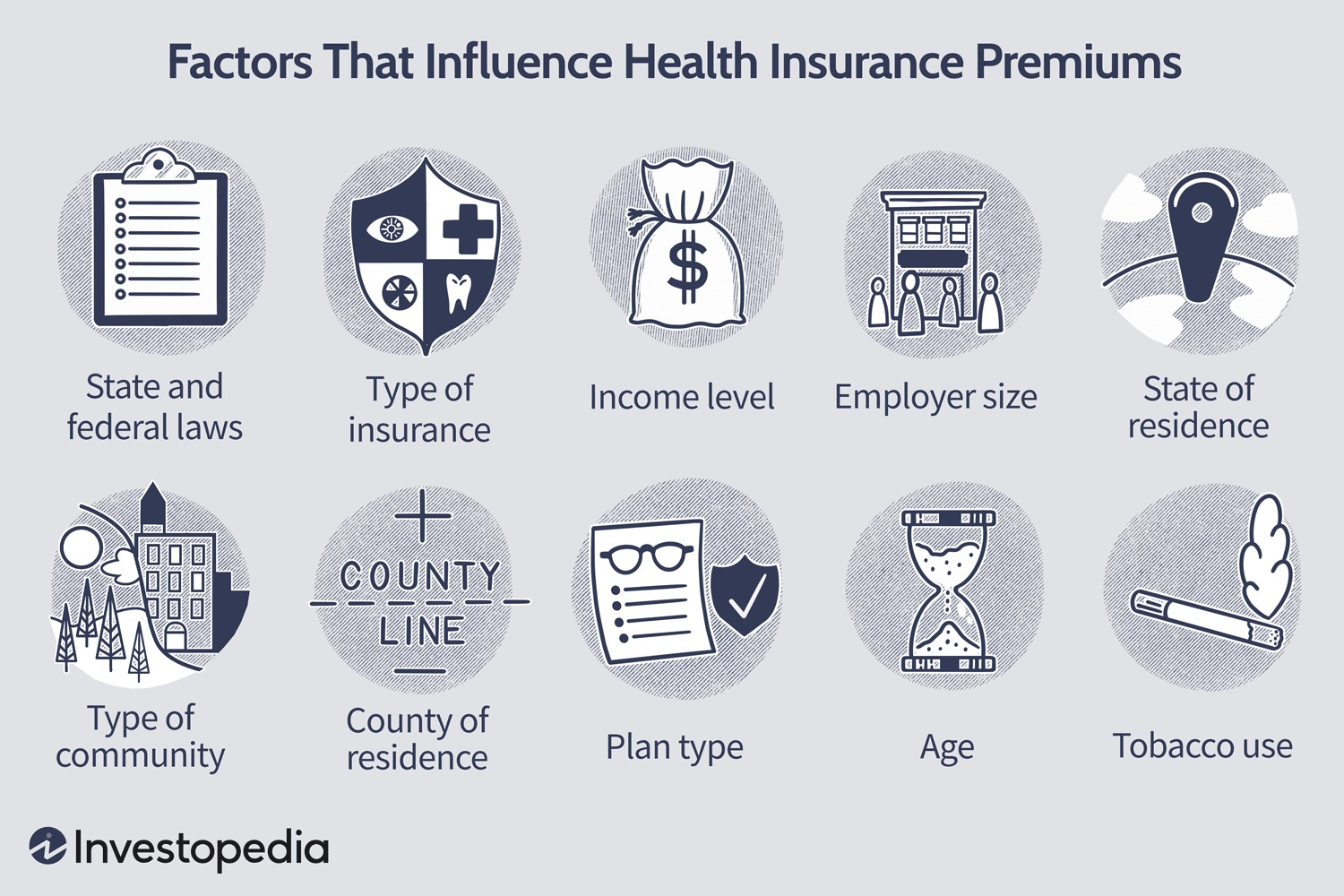

Health insurance costs are a critical aspect of healthcare planning. Understanding these expenses is essential for making informed decisions about coverage. Let's delve into the factors influencing health insurance costs and how you can navigate this landscape.

Factors Impacting Health Insurance Costs

1. Type of Plan:

Health insurance plans vary significantly, from HMOs to PPOs and beyond. Each plan type comes with its own cost structure.

2. Coverage and Benefits:

The extent of coverage greatly influences costs. Plans covering more services tend to have higher premiums.

3. Deductibles and Copayments:

Plans with lower deductibles and copayments usually have higher premiums and vice versa.

4. Age and Location:

Age and location impact costs. Older individuals and certain regions might have higher premiums.

5. Personal Health History:

Pre-existing conditions can affect costs, with some plans charging higher premiums based on health history.

Strategies to Manage Health Insurance Costs

1. Compare Plans:

Research and compare different plans to find the best fit for your needs and budget.

2. Utilize Health Savings Accounts (HSAs) or FSAs:

These accounts allow you to set aside pre-tax money for medical expenses, reducing your overall costs.

3. Opt for Preventive Care:

Many plans offer free preventive services. Utilize these to maintain health and avoid potential costly issues.

4. Stay In-Network:

Choosing healthcare providers within your plan's network can significantly lower out-of-pocket costs.

5. Review and Adjust Coverage Annually:

Life changes may impact your insurance needs. Regularly review your coverage to ensure it aligns with your current situation.

Conclusion

Navigating health insurance costs involves understanding various elements that contribute to pricing. By assessing your needs, comparing plans, and considering cost-saving strategies, you can better manage and optimize your health insurance expenses.